Launching a firm might be simple, but handling all the stuff and keeping track of payments surely isn’t. That’s where payroll software comes into the role. The internet is packed with tons of payroll-related tools that help you stay on top of the business.

One such anticipated option is the Wagepoint. A one-of-a-kind tool, this payroll software never lets you worry about the basics while making it simple for you to pay everyone. In addition, this software allows you to manage payroll taxes, too, thus easing your process. Wagepoint is one of the most user-friendly and comprehensive options to opt for and is thus recommended.

Want to know more about Wagepoint and how to log into the account? Scroll through the guide and learn every tidbit about the software to avoid any hassle later.

What is Wagepoint?

Wagepoint is a payroll software that allows businesses to manage their payroll processes. The software is designed to help businesses save time and money by automating payroll tasks. Wagepoint offers a variety of features, including online pay stubs, direct deposit, tax filing, and employee self-service.

It is a web-based payroll software that offers businesses of all sizes a simple, efficient, and accurate way to process their payroll. Wagepoint is designed with simplicity in mind. It is easy to use, even for those with no prior experience processing payroll.

Moreover, it offers an affordable solution for businesses of all sizes. There are no hidden fees or long-term contracts, so you can be confident that you’re getting the best value for your money. You can rely on Wagepoint to accurately calculate and process your payroll every time. They use the latest technology to ensure that the software is always up-to-date and compliant with Canadian payroll regulations.

What Makes Wagepoint Stand Above the Rest?

Here are 5 features of Wagepoint that make it the ideal payroll solution for businesses in Canada. Check them out and see if the software is worth adding to your app drawer.

- Time-saving

With Wagepoint, you can say goodbye to the tedious and time-consuming task of manually processing payroll. This software automates many of the tasks involved in payroll processing, so you can save valuable time and focus on running your business.

- Automates Payroll Taxes and payments

Payroll taxes can be a complex and time-consuming task, but with Wagepoint, you can easily automate them. By using the software, you can easily calculate and withhold the correct amount of payroll taxes from each employee’s paycheque. This includes both federal and provincial taxes. The software also supports the electronic filing of payroll taxes, which can save you even more time.

- Supports Direct Deposits

Businesses don’t have to worry about the grueling deposit process as the software supports direct deposits and payments to ease the process. It also offers online access to paystubs.

- Easy-to-use interface

The interface is simple-to-understand and straightforward. The left side of the screen has a navigation menu with all the different features and options. The right side is where you can see your recent activity and any upcoming tasks or deadlines. The software is easy to use and can be accessed from any computer or mobile device with an internet connection.

- Offers excellent, friendly support

If you’re looking for payroll software in Canada that offers excellent customer support, Wagepoint is a great option to check out. They offer 24/7 customer support via phone, email, and live chat, so you can always get the help you need. And their team is very knowledgeable and helpful, so you can feel confident that your questions will be answered.

A Step-by-Step Guide to Log Into Wagepoint

If you are a Canadian business owner, you understand the importance of having a sound payroll system in place. Wagepoint is one of the leading payroll software providers in Canada and offers a number of features that can save you time and money.

It offers a secure login and sign-up process. When you first open the home page, you’re greeted with a login page. If you don’t have an account, there’s a big sign-up button in the left corner of the screen. Clicking it takes you to a short form where you enter the information asked. Once you’ve submitted that, you’re taken to the main dashboard.

Sign Up for Wagepoint Account

Follow the steps below to create an account and begin using Wagepoint:

- Go to the Wagepoint website and click “Sign Up” in the top right-hand corner.

- Enter your personal information, including your name, email address, and phone number. You can select your country by ticking the checkboxes, saying Canada and US.

- Choose a unique password for your account and enter a promo or referral code, if any.

- Review the Terms of Service and Privacy Policy, then check the box indicating that I’m not a robot.

- Click on the button that says “Get Started,” and you are done.

Log into the Wagepoint account

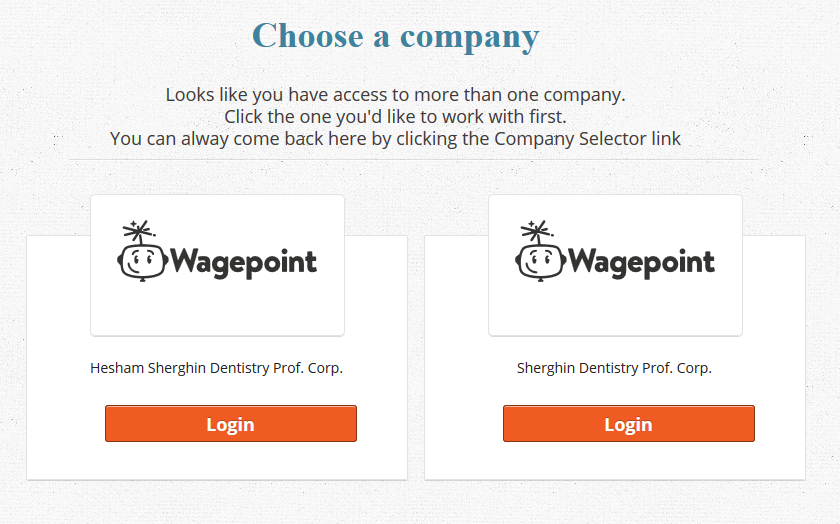

Now that you are signed up Wagepoint account, it’s time to access the dashboard.

- Go to the Login window available on the homepage.

- Enter your Email/ username and password in the respective fields and click on the Login button to continue.

- If you forget the password, worry not and click on the Forget password button to retrieve your credential in a matter of seconds.

Once you are logged in, you will be taken to your Dashboard, where you can manage your account settings and view your payroll information.

From the Dashboard, you can access all of the features of Wagepoint, including setting up employees, managing payroll, and running reports. You can also add other users to your account so they can help manage your payroll information.

Conclusion

There you have it. Wagepoint is an online payroll software that helps Canadian businesses pay their employees and contractors on time. To sign up for Wagepoint, you must provide your business information, including your company name, address, and contact information. You will also need to create a username and password. Once you have signed up, you can add employees and contractors to your account and start processing payroll.

We hope you have enjoyed the post and found it resourceful. If anything bothers you, feel free to share your feedback with us in the comment section below. We would love to hear from you.